Uniswap's $UNI Governance Token

Uniswap gave 251k Ethereum Addresses (users) 400 $UNI tokens ($1750) each

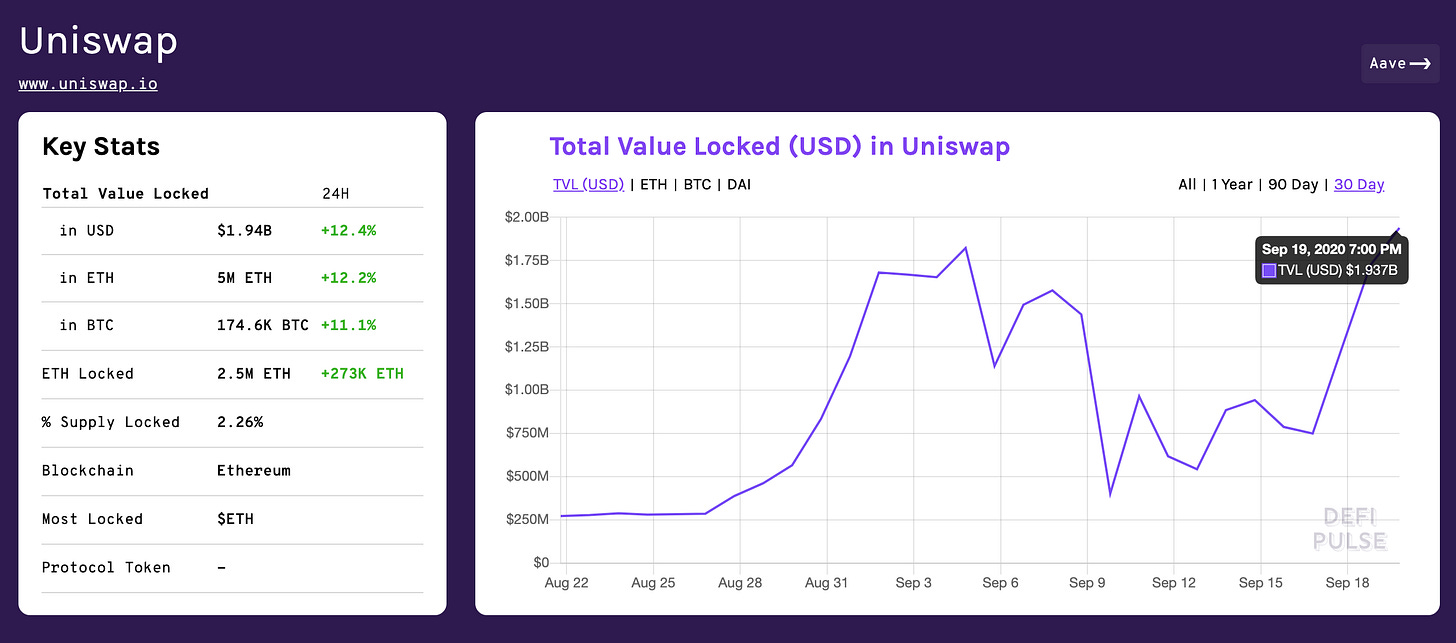

Uniswap proved once again how much of a DeFi powerhouse it truly is. After losing over $1B of liquidity to the SushiSwap Vampire Attack a couple weeks back, Uniswap has now attracted a total liquidity back up to near $2B.

Gas prices exceeded 750+ gwei after news of the $UNI token dropped. Miners were earning 10+ ether per block for nearly 12 hours. For reference, the regular inflation reward is 2 ether per block so 8+ ether was paid per block in transaction fees. This made the Ethereum network pretty much unusable for anyone experimenting with applications. Ethereum also experienced its highest number of 1,406,016 transactions on Thursday, September 17, 2020.

Market Update (Monday 8:30 AM EST)

Percent Change (Rounded) Based on Last Monday Open (8:30 AM EST)

Bitcoin- $10,598 (-2%)

Ether- $346.56 (-10%)

Gold- $1,887 (-3%)

DJI Average- 27,484 (-1%)

NYSE Composite Index- 12,617 (-2%)

NASDAQ Composite Index- 10,610 (-4%)

S&P500 Index- 3,285 (-3%)

New Developments

Skale Completes $5M Token Sale on ConsenSys Platform, CoinDesk

Uniswap Governance Token, Uniswap Blog

Introducing Upshot One; A Q&A Protocol

Introducing Harvest.io, the world’s first cross-chain money market

This Week in Blockfolio Signal — Ethereum, Tezos, Polkadot, iExec

Kraken Wins Bank Charter Approval, Kraken Blog

Industry Insights

Enterprises Need Third Parties for Oracles to Work, Paul Brody

Zcash Value Thesis, Placeholder VC

Stop Burning Tokens - Buyback and Make Instead, Joel Monegro

Bitcoin Explainer For Your Mom, Forbes

Michael Saylor, CEO of Microstrategy, Confirms Bitcoin Rumors

For Developers

Binance Smart Chain Documentation, Binance Docs

Ethereum Developer Guide, Snake Charmers

How Diamond Storage Works, Nick Mudge

How To Code Gas-Less Tokens on Ethereum, HackerNoon

Blockchain Activity

Create an owner of a contract with an event, constructor, modifier, and functions:

*Tools: Metamask, Remix IDE, Ethereum

# set pragma

pragma solidity ^0.5.0;# contract

contract Owner {

address private owner;

// event for EVM logging

event OwnerSet(address indexed oldOwner, address indexed newOwner);

// modifier to check if caller is owner

modifier isOwner() {

require(msg.sender == owner, "Caller is not owner");

_;

}

constructor() public {

owner = msg.sender; // 'msg.sender' is sender of current call, contract deployer for a constructor

emit OwnerSet(address(0), owner);

}

function changeOwner(address newOwner) public isOwner {

emit OwnerSet(owner, newOwner);

owner = newOwner;

}

function getOwner() external view returns (address) {

return owner;

}Earn Opportunity

The past week Uniswap announced the launch of their native governance token $UNI. This token will be used as an incentive mechanism for liquidity providers on Uniswap as well as voting and proposing within the protocol itself. Uniswap nailed the community distribution mechanism by designating 400 $UNI ($2000+) to any Ethereum address that has ever interacted with Uniswap for trading or liquidity provision purposes. You can read more about the Uniswap governance token here.